Welcome, Wonks!

Happy Belated Birthday to Family First, which turned 7 yesterday.

This week we’ll dig into legislative news, dive deep on TANF, and talk CBO.

What’s Happening in Child Welfare

Child Welfare Policy Implications of Reconciliation

First up, you likely know Congress will consider major legislation this year using budget reconciliation. So, what is that, and why does it matter for child welfare?

Congress isn’t planning to craft new child welfare policy. But key child welfare programs could face cuts to offset new spending, like tax cuts.

Programs that could see significant cuts or elimination include:

Temporary Assistance for Needy Families (TANF)

Cash assistance and much more, see the deep dive below!

~19% of federal child welfare spending1.

Social Services Block Grant (SSBG)

Very flexible funding, serves children and families.

10% of federal child welfare spending.

Medicaid

Federal-state health insurance program covering:

Almost half of all children;

Nearly all (99%) children in foster care;

Children with special needs adopted from foster care;

Youth who age out of foster care, up to age 26; and

7% of all federal child welfare spending.

To fully see these implications, it helps to understand the parliamentary procedure.

So, it’s time for our first… Parliament Wonkadelic Breakdown!

Unlike George Clinton, our breakdown will be decidedly lacking in funky grooves, but we will try to make up for that with procedural minutiae, charts, and gifs. Let’s go!

Everything You Wanted to Know About Budget Reconciliation (But Were Afraid to Ask…)

Talking about budget reconciliation without understanding it is a rite of passage for policy wonks. That’s because it is as consequential as it is confusingly complicated.

Part of what makes reconciliation complex is that it was made for one thing but now is used for something totally different, like how bubble wrap was originally a wallpaper.

The Congressional Budget Act of 1974 (P.L. 93-344) created reconciliation to let Congress change revenue, spending, or the debt limit to match the budget resolution.

It turned out that this tool was excellent for surmounting the gridlock that comes from small Congressional majorities;2 it moves quickly and isn’t subject to the filibuster.

Process-wise, reconciliation occurs in two stages, so let’s break them down.

Stage One: Crafting and Drafting

The House/Senate Budget Committee crafts a budget resolution. This instructs the relevant committee(s) to draft legislation following that blueprint by a deadline.

The budget committee consolidates those submissions. Then there’s a review to ensure each policy follows the Byrd Rule (as in former Senator Robert Byrd).

If it doesn’t impact revenue or spending, it has to go. The nonpartisan parliamentarian does this review, which is called the Byrd Bath, because of course it is.

Stage Two: Vote-A-Rama & High-Stakes Drama

Finished reconciliation bills then get expedited consideration. In the Senate, this also includes the fabled “Vote-A-Rama” process of seemingly limitless amendments.

And then the high-stakes drama, like McCain’s famous thumbs down, dooming repeal of the Affordable Care Act. With vote margins this close, it’s not over until it’s over…

Okay, that’s a lot of nerdy process. Let’s wake everybody back up. Here’s the most recent fruit of my favorite google search pick-me-up: “Unusual Animal Friendships”.

Better?

So what in the world does any of this mean for this reconciliation and child welfare? Congress is divided on how to handle that, too!

Leaders in the Senate and House have alternative approaches to handling the reconciliation process, wanting two separate bills or one big one, respectively.

A very drafty Senate proposal emerged on Friday, with a potential markup this week. The House also could decide to move this week.

Wonky Deep Read: The draft Senate instructions do NOT name the House Ways and Means Committee.

In Congress, each committee “owns” certain law/policies, called their jurisdiction.

Since Ways and Means has jurisdiction over SSBG and TANF, the Senate bill having no W&M instructions would leave them out for now. That could change, of course.

Wonky Timing Note: Recesses offer both 1) delay and 2) time for Members to hear about legislation back home. Neither tends to increase legislative momentum…

The only thing that’s certain is that all of this is currently written in pencil. Expect more changes. Child Welfare Wonk will continue to break this all down for you.

An RFI on AI

Following up on our note about emerging technology, the White House Office of Science and Technology Policy (OSTP) wants input on AI policy.

What’s Happening: This Request for Information (RFI) will gather input to inform the Administration’s Artificial Intelligence Action Plan.

Why does this matter? Child welfare has mature perspectives on AI to share from experiences like predictive analytics and algorithmic clinical tools.

How do you weigh in? Send an email with your comment letter to ostp-ai-rfi@nitrd.gov, with “AI Action Plan” in the subject line, by March 15, 2025

Okay now on to a TANF deep dive!

TANF Deep Dive

Continuing our deep-dives, let’s talk Temporary Assistance for Needy Families (TANF).

The Congressional Research Service (CRS) has a great comprehensive report on TANF. There is also an excellent podcast series on its origin.3

Comprising ~19% of federal child welfare spending, TANF is a block grant, which is wonk speak for a set pot of funds to states and tribes with requirements and rules.

Total federal TANF funding is $16.5 billion per year. That has not changed since 1996, which means TANF has lost 49 percent of its value to inflation from 1997 to 2024.4

TANF replaced the Aid to Families with Dependent Children (AFDC) program, shifting from an open-ended entitlement program to a block grant.

States also have a Maintenance of Effort (MOE) requirement. This is wonk-speak for ensuring states don’t cut their spending and replace it with federal funds.

TANF funds anything “reasonably calculated” to achieve its four statutory purposes:

Provide assistance to needy families so that children may be cared for in their own homes or in the homes of relatives;

End the dependence of needy parents on government benefits by promoting job preparation, work, and marriage;

Prevent and reduce the incidence of out-of-wedlock pregnancies; and

Encourage the formation and maintenance of two-parent families.

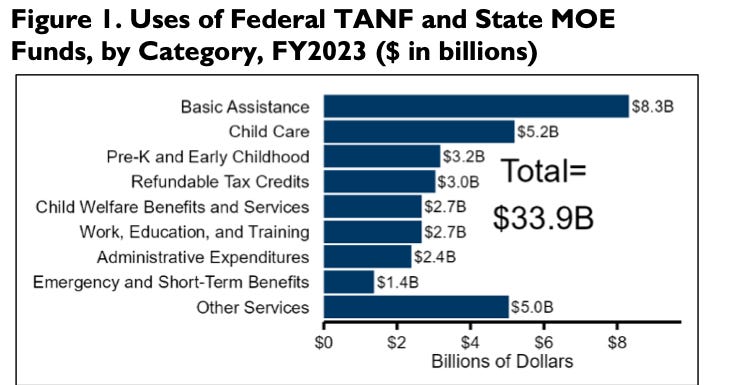

This figure from CRS shows combined federal and state TANF funding by topic:

Often, TANF is synonymous with “welfare”. Many wonks are then surprised to learn that only ~20% of TANF goes to direct cash assistance.5

TANF has lots of rules for cash assistance, including that it is:

Only for families with a dependent child;

Limited to five years; and

Subject to state-set maximum benefits, ranging from:

$915 in New Hampshire; to

$162 in Arkansas in 2022.

TANF also has a “child only” benefit that does not look at caregiver income, often used to support children in kinship care. Nearly half of TANF cases are “child only”.6

TANF also has work requirements, tied to performance standard for states, using the wonktacularly named minimum work participation rate (WPR).

Since you noticed that there are many categories of activities within TANF, you likely have surmised that it covers many things that are… not what you would expect.

To illustrate that breadth and the risks it raises, we have a football-related example.

Warning- it’s little older than last night’s big game. So much so that, much like Matt Dillon, you may find yourself asking Cameron Diaz, hang on…

If you haven’t yet heard this Mississippi TANF story, it centers on over $90 million in TANF funds from 2016 to 2019 that went to some… questionable purposes.

This included $1 million in speaker fees to Favre (for events he did not attend…) and $5 million to build a volleyball stadium at the university his daughter was attending.

You can see more from this September 2024 hearing with Brett Favre himself. This issue is not unique; these kinds of uses are often permissible under the four purposes.

In addition, this January 2025 GAO report discusses fraud in TANF, highlighting the program’s vulnerabilities to misuse and offering recommendations to fix them.

However, none of this is to say that TANF is frivolous. To the contrary, you can see just how central it is to child welfare funding.

TANF and Child Welfare

ChildTrends has a great brief specific to TANF from its most recent Child Welfare Financing Survey.

From that we know that states spent ~$2.6 billion in TANF funds on child welfare services in State Fiscal Year 2020.

Some of the things TANF can fund that have relevance to child welfare policy are:

Economic support to relative caregivers not in the formal child welfare system;

Payments for kinship care and adoption/guardianship assistance;

Foster care payments, particularly for non IV-E eligible children;

Child Welfare Services, including:

Family preservation;

Adoption services;

Legal support;

Transportation; and

Independent living.

Much more!

States can also transfer up to 10% of their TANF funds to SSBG, for even more flexible uses, many of which overlap with child welfare.

Learn More About TANF

As you can see, TANF has a broad array of uses related to child welfare policy, and it remains a key tool states use in their work. And now before we wrap, let’s talk data.

CBO: All About that Base(line)

We started this week talking about reconciliation, so I would be remiss to not share about the Congressional Budget Office (CBO) and its all important budget baselines.

What is CBO? The nonpartisan scorekeeper of legislative policy.

What does CBO do? They analyze legislation’s impact on federal spending and the economy, known as the bill’s “CBO score”.

Who cares? Anybody who wants to enact legislation. Scores make or break a bill.

Okay, this sounds important. But, what’s a baseline? The CBO baseline is their ten-year projection of spending and revenue, assuming current policy.

You can see the latest baseline projections, including for Medicaid, CHIP, TANF.

Do they have specific child welfare data? They sure do! For example, here’s a specific baseline for Title IV-E of the Social Security Act.

Have a good week, Wonks!

Astute readers may see that the ChildTrends survey lists TANF as both 18% and 19% of federal child welfare spending in its text and charts, respectively. This reflects the difficulties of smoothing and reconciling voluntary data when not all agencies report. The important thing for our purposes is, they’re close!

Like currently, with 218-215 in the House, and 53-47 in the Senate

And you can accompany it with jams from the Work Makes the Difference album that a local TANF office made to celebrate the dignity of work…

See this CRS report

Again, see this CRS report

See the most recent relevant HHS report

Should have read it more closely - I think they’re just trying to roll the House. So it could matter if the House can’t do their own res, which seems possible

I know you know better, Zach, but a Senate Budget Committee instruction would never instruct Ways and Means for the programs discussed, it would give Senate Finance instructions since they have the relevant Senate jurisdiction.