Welcome, Wonks!

This week we’ve got Warren G levels of regulatory news, reconciliation updates, and complementary GAO and Child Welfare Wonk analyses on TANF and child welfare.

Child Welfare & Health: The Medicaid and CHIP Payment and Access Commission (MACPAC), a nonpartisan advisory body to Congress, had its April meeting last week.

MACPAC has expanded its focus on child welfare in recent years, and this meeting discussed health access for kids in foster care and access to residential treatment.

On to this week’s major updates!

RIF Readout Redux: ASPE Edition

Last week we broke down the impact of the recent 10,000 person HHS Reduction in Force (RIF) on ACF. More news articles have covered ACF since then.

This week we have additional child welfare relevant updates, on the HHS Assistant Secretary for Planning and Evaluation (ASPE) office.

More Child Welfare Impacts: In addition to ACF, another aspect of the RIF that impacts child welfare is the elimination of the Human Services’ Division of Data and Technical Analysis.

The Divisions of Children and Youth Policy and Family and Community Policy technically remain, though Child Welfare Wonk is only aware of one remaining child welfare analyst after recent voluntary and mandatory staff reductions.1

Our understanding is that ASPE will merge with the Agency for Healthcare Research and Quality as part of a new Office of Strategy. We don’t yet know what that means for human services policy.

What ASPE Does: ASPE develops legislative proposals, conducts policy research, and performs economic analysis.

ASPE’s Child Welfare Research: ASPE’s child welfare work includes longstanding research on child welfare policy and outcomes.2

ASPE’s recent work includes building linked data, offering insights into outcomes and expenditures for the same children across Medicaid and child welfare programs.

ASPE’s Child Welfare Policy Role: ASPE also plays important roles in child welfare policy development. These include:

Eligibility formula calculations. ASPE has a team that calculates HHS poverty guidelines each year. Many programs use them for eligibility determination.

Economic Analysis. Federal law requires major regulations to have a Regulatory Impact Analysis. ASPE helped ACF teams do this work, and reviews all HHS RIAs.

Policy Research. ASPE research informs policy development and oversight. Work by ASPE has influenced extensive bipartisan legislation over the years.

Impact on Child Welfare Policy: We can reasonably anticipate that without this team we could see impacts on child welfare policy that include:

Less Economic Analysis. ASPE’s expert economists supported and approved ACF policy teams’ RIA analyses.

Possible Rise in Eligible Families Without Benefits. Poverty calculations ensure programs pace with inflation. Otherwise eligible families may not get services.

Less Fiscal Oversight. Linked data on child welfare and Medicaid would be a treasure trove for identifying waste, fraud, abuse, and inefficiencies.

What Next: News reports suggest HHS is reconsidering some of the RIFs based on inadvertent impact on critical health programs.

HHS Secretary Kennedy may recall up to 20 percent of impacted staff. We don’t yet know if that includes any positions at ACF and will keep you updated.

DOGE Overseeing Grants, Facing Oversight Questions

Amidst lots of ongoing changes with the U.S. Department of Government Efficiency,3 there are developments with significant child welfare implications.

DOGE Becoming Air Traffic Control for Grants.gov

The Latest: Officials across federal agencies have received instructions that any notice of funding opportunity (NOFO) for Grants.gov must go through DOGE.

What Grants.Gov Does: Multiple federal agencies post ~5,000 NOFOs annually on Grants.gov, a centralized platform that receives 10 million visits annually.

What it Means: Centralization of grants dissemination changes the traditional workflow for grant approvals and adds additional review steps.

Child Welfare Implications: HHS is ~20% of Grants.gov NOFOs.

What Comes Next: Planned grant notices now must go through grantreview@hhs.gov, which DOGE monitors.

Oversight Questions on DOGE Access to Child Support Data

The Latest: On April 10th, U.S. Senate Finance Committee Ranking Member Ron Wyden (D-OR) led a letter requesting details about child support enforcement data.

What’s Happening with Child Support Data: In early March the Trump Administration’s Department of Government Efficiency (DOGE) received read-only access to the National Directory of New Hires (NDNH)4.

What the NDNH is: Overseen by ACF’s Office of Child Support Services (OCSS), the NDNH tracks personal data about anyone who fills out a Form W-4 for tax withholding.

The Oversight Letter: The letter to Treasury Secretary Scott Bessent and HHS Secretary Robert F. Kennedy Junior poses questions about the purpose and extent of DOGE access, and what privacy protections they are providing.

What Comes Next: The letter requests written responses and a briefing for the Senate Finance Committee no later than May 5.

White House Orders Reg Repeal

On April 9, President Trump issued a memo titled Directing the Repeal of Unlawful Regulations that directs agencies to repeal regulations without notice and comment.

What it Does: The memo instructs agencies to review their regulations and repeal any inconsistent with recent U.S. Supreme Court decisions on regulatory authority.

What it Means: Recent U.S. Supreme Court decisions like Loper Bright Enterprises v. Raimondo changed deference federal agencies receive in writing regulations.

Wonks Read Closely: It’s worth noting that a core component of the memo is Loper, but the decision itself explicitly says the court majority does “not call into question prior cases that relied on the Chevron framework.”

Child Welfare Implications: It will be worth watching for any ACF regulatory changes that could occur following this memo.

What Happens: This action is already facing court challenges. We’ll monitor for you.

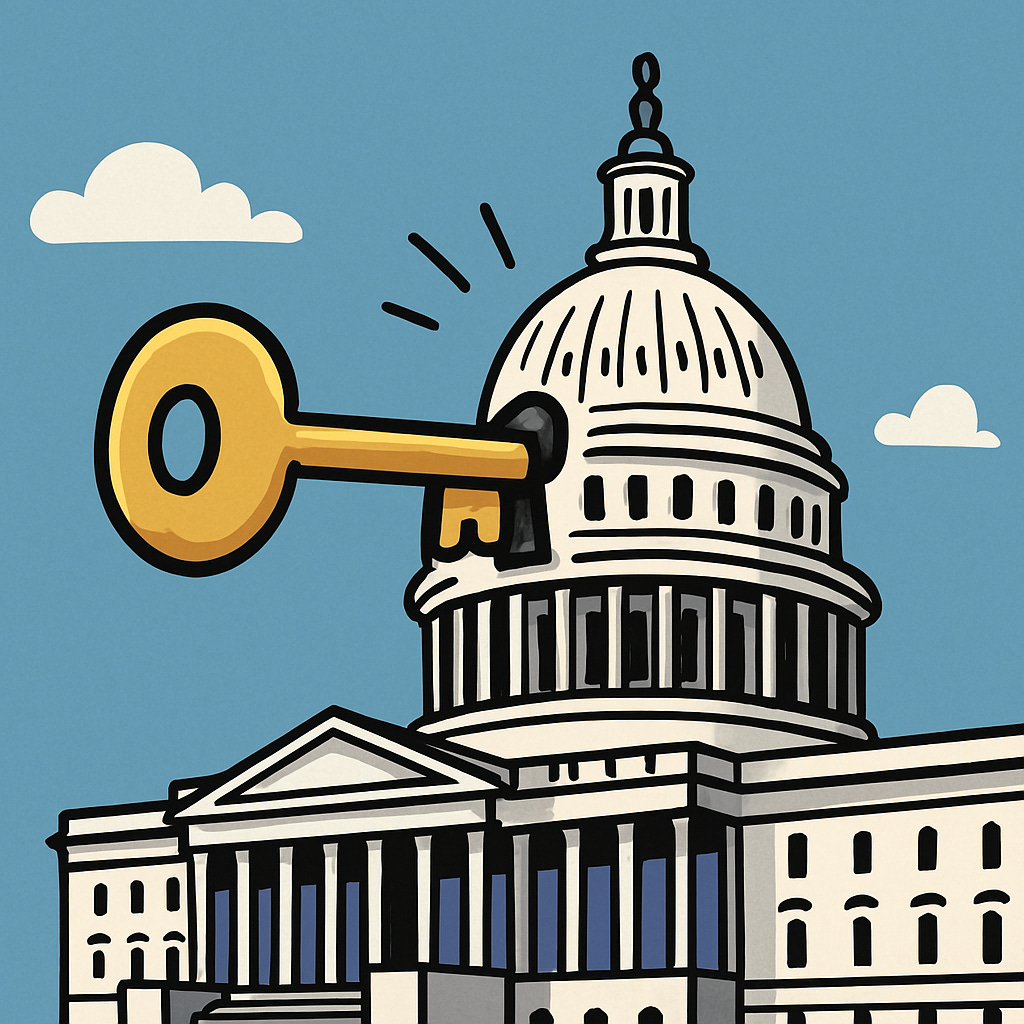

Reconciliation Unlocked

The Latest: On April 10, the U.S. House approved 216-214 the Senate-passed budget resolution, unlocking the reconciliation process.

What This Means: Reconciliation is now fully underway. Congressional committees will begin the work of crafting actual legislative text.

Reconciliation Reminder: Our reconciliation overview and recent forecast of state-by-state effects of possible spending cuts in reconciliation remain relevant.

This simple-majority fast-track legislative procedure could create cuts to child welfare programs, as part of spending reductions it must include to offset tax policy changes:

Social Services Block Grant (SSBG);

Temporary Assistance for Needy Families (TANF); and

Medicaid.

This map highlights the projected child welfare cuts nationwide.

What the Latest Action Means for Child Welfare: Action now moves to key committees, which will begin crafting actual legislation.

For child welfare, the key ones to watch are the Senate Finance Committee and House Energy and Commerce and Ways and Means Committees.

Forecasting Factors Impacting Child Welfare Cuts: The cuts to Medicaid, SSBG, and TANF are still on the table, but also not a done deal.

As your resident Wonkstradamus, here’s some forecasting factors to consider:

Politically influential & uniquely Medicaid-sensitive states

Three states expanded Medicaid via constitutional amendments:

Missouri (home of U.S. House Ways and Means Committee Chairman Jason Smith, and Senator Josh Hawley, who co-led a Senate amendment to leave Medicaid cuts out of reconciliation.);

Oklahoma (home of Senator Markwayne Mullin, known for having a strong personal relationship with President Trump and House Republicans); and

South Dakota (home of Senate Majority Leader John Thune).

These states are uniquely exposed to Medicaid expansion changes and have powerfully influential Members in their delegations. That Venn diagram is worth watching.

Additional Medicaid Concerns

House GOP moderates and front-liners, including Foster Youth Caucus Co-Chair Don Bacon (R-NE), have expressed concern over cutting Medicaid.

These are not the only members facing a similar analytical calculus, and more may emerge as details on legislation become clear.

Clean Energy Defenders

Four GOP Senators signed a letter urging leadership not to repeal clean energy tax credits in the Inflation Reduction Act (P.L. 117-1695).

Astute Wonks will note that this is one other possible spending reduction source (beyond Medicaid) for the House Energy & Commerce Committee, which has reconciliation’s biggest savings assignment.

Budget Hawk Cut Concerns

On the other side of the ledger are Members who think the cuts under discussion are far too small.

This group incudes House Freedom Caucus members and Senators like Rand Paul (R-KY), Ron Johnson (R-WI) and Mike Lee (R-UT).

Razor-Thin Vote Margins

The budget resolution passed the Senate 51-48 and the House 216-214.

In many ways, the easiest part is over. It only gets more complex now.

Concessions to secure one set of votes can lose other equally essential votes.

This wonktacularly long and non-exhaustive list means that the outcome of reconciliation remains undetermined. We will keep breaking this down for you.

New Data on TANF & Child Welfare

On April 8, the U.S. Ways and Means Subcommittee on Work and Welfare held an oversight hearing on Temporary Assistance for Needy Families (TANF).

Hearing Focus: TANF’s accountability and fraud risks, with testimony from multiple U.S. Government Accountability Office experts and an OH county agency director.

TANF Concerns: GAO’s report notes that 37 states have 162 TANF audit findings. One third fell into the highest category of audit concern.

Findings showed audit concerns persisted too; over three dozen findings were unresolved after 2+ years, and some lasted over a decade.

GAO noted it has previously raised concerns around HHS support of state audit resolutions, enforcement action, and fraud risk assessment.

TANF is overseen by the Office of Family Assistance, which has lost 40% of its staff, including those that distribute TANF funds to states.

We don’t yet know how these changes will impact program oversight and integrity.

TANF Complexity: TANF's structure includes “assistance” (direct financial support) and “non-assistance” (everything else). The complex eligibility rules for assistance drive increasing shifts toward non-assistance.

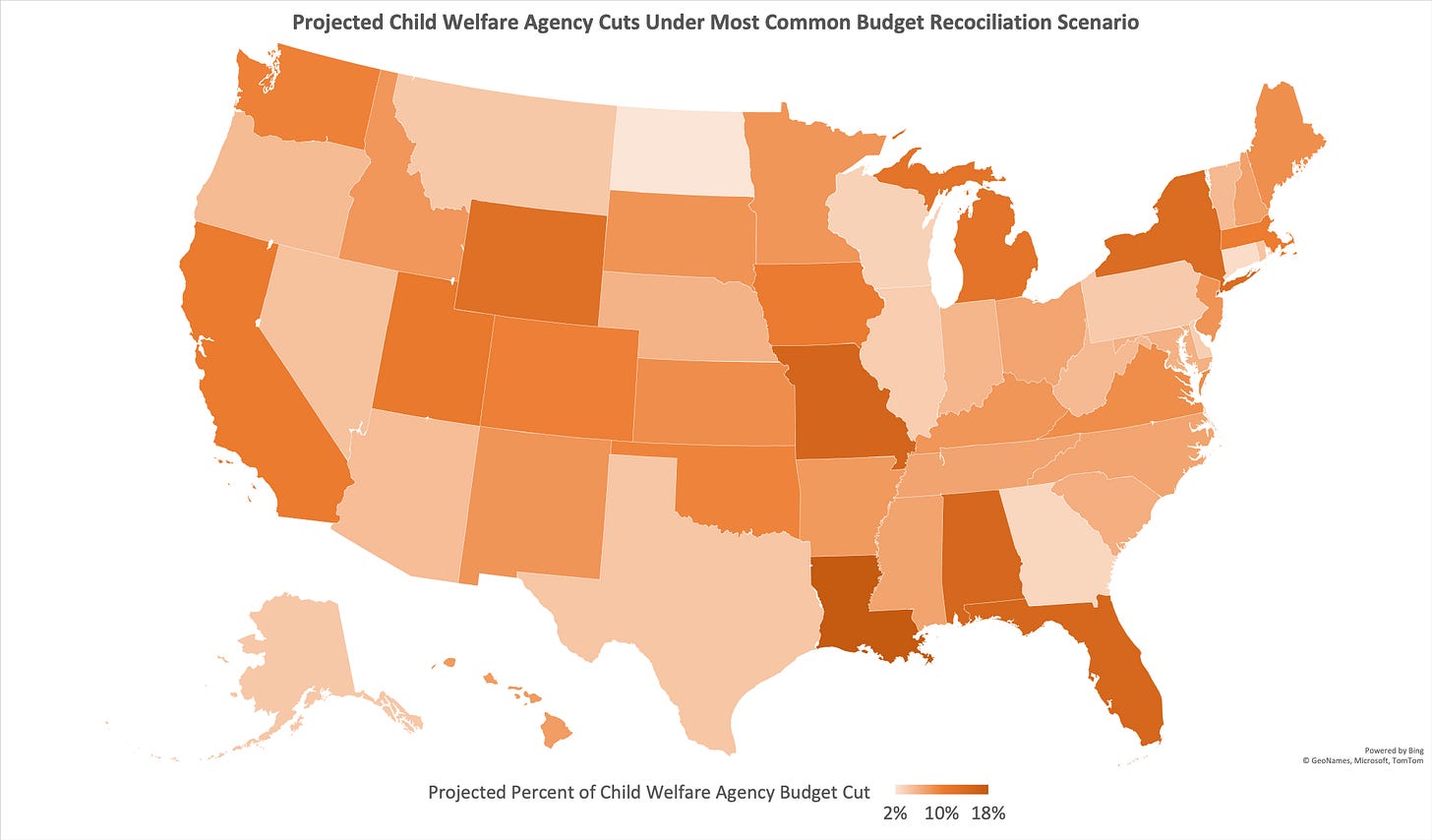

New Child Welfare & TANF Report Drops: GAO also released a new report looking at how TANF works with other federal funds to support child welfare services.

Report Findings: The report highlights the central role of TANF in federal child welfare financing. It notes that from FY2015-FY2022, states reported :

$68.6 billion in Title IV-E spending;

$4.4 billion in Title IV-B funding; and

$23.5 billion in TANF spending just for child welfare.

TANF’s Child Welfare Role: TANF plays a major role in child welfare financing, supporting an array of activities, including:

Financial resources for kin caregivers

Foster care maintenance payments for children who are not eligible for Title IV-E.

Family support, family preservation, and reunification services;

Adoption services; and

Much more, including the authority to transfer up to 10% of TANF funds to SSBG, which itself can also fund child welfare activities.

The breadth of things TANF does in child welfare points both to its evolution within the basic assistance eligibility constraints, and the limits of other federal funds.6

These broad activities include both unique and overlapping functions to other federal

Wonks Dig Deeper: FY23 TANF Child Welfare Expenditure Data

This is Child Welfare Wonk; we couldn’t help but notice that these extensive new GAO reports only go up to FY2022 data.

ACF has FY2023 TANF expenditure data too though, so we had to dig in and add to what GAO has offered.

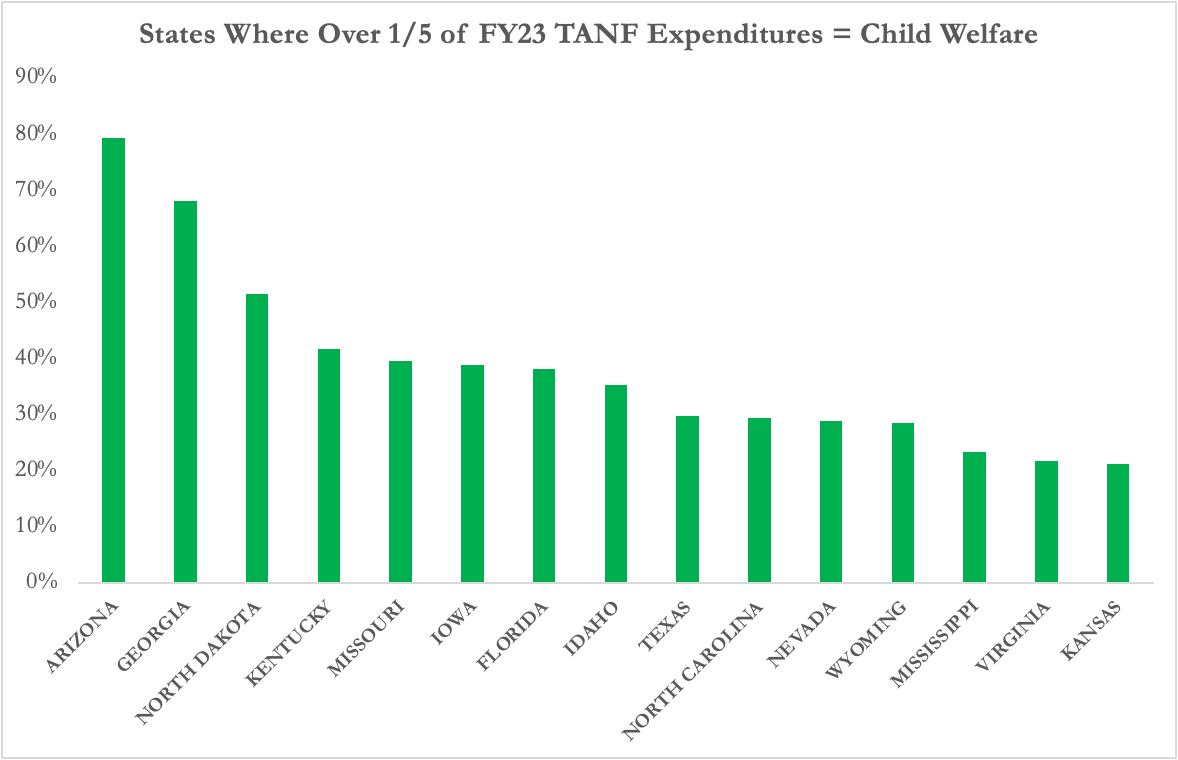

Fifteen with One-Fifth

This chart shows the 15 states that have 20 percent or more of their FY2023 TANF expenditures going to child welfare7:

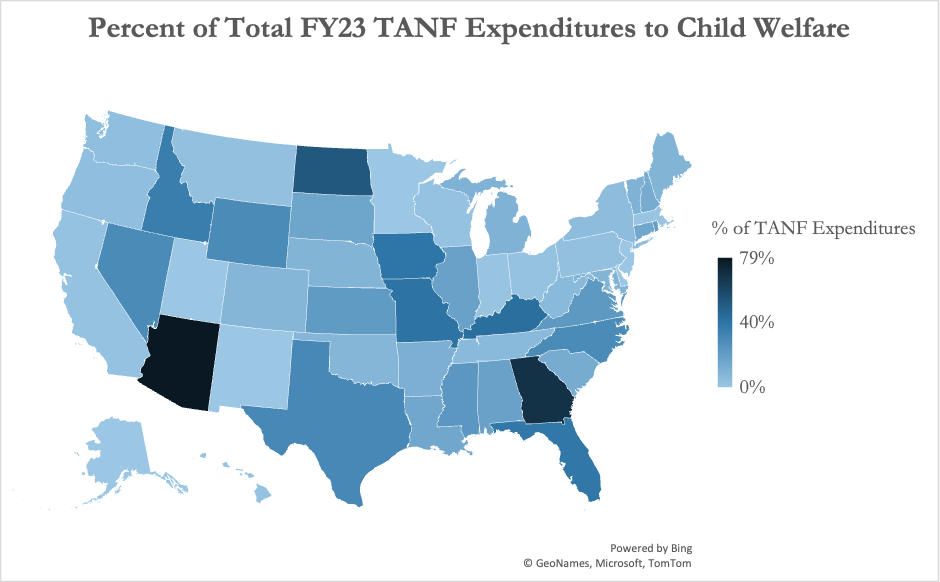

To add some national perspective, this map shows the percent of total FY2023 TANF expenditures that went to child welfare.

What it Means for Child Welfare Policy: Changes to TANF in budget reconciliation or from staff reductions would have significant child welfare financing implications.

Long-term, the evolving changes across federal financing programs raise questions about bipartisan opportunities to optimize operation across all federal programs.

That’s plenty for this Spring Break.

Have a good week, Wonks!

Corrected- an earlier version of this update incorrectly characterized this as the elimination of the entire human services team at ASPE. We have updated this to reflect the maintenance of divisions.

Wonks know it’s technically not a Department, and is a rebrand of the U.S. Digital Service…

You can learn more about the NDNH from this Congressional Research Service report.

Wonks will note this major legislation was also a product of budget reconciliation…

For example, our 20-year IV-E analysis shows how inflation impacts IV-E eligibility. At the same time it’s getting harder to provide TANF basic assistance it’s also getting harder to fund foster care with IV-E.

For interested Wonks, our analysis specifically pulled the total (i.e. federal and state) expenditures for these categories:

6.b. Basic Assistance -

Relative Foster Care Maintenance Payments and Adoption and Guardianship Subsidies

7.a. Assistance Authorized Solely Under Prior Law -

Foster Care Payments

8.a. Non-Assistance Authorized Solely Under Prior Law -

Child Welfare or Foster Care Services

20.a.Child Welfare Services-Family Support/Family Preservation /Reunification Services

20.b.Child Welfare Services-Adoption Services

20.c.Child Welfare Services- Additional Child Welfare Services