Introducing Child Welfare Wonk's Funding Uncertainty Vulnerability Index

Vibes aren't enough, wonks need charts!

Welcome, Wonks, and a Happy Saint Patrick’s Day to all!

Only some green charts this week; when you have a red beard that gives “pays for craft beer with crypto” vibes, too much enthusiasm risk looking leprechaun-y.

Sans Shutdown, CR Cuts Child Welfare

Level on the Toplines, But…

On March 14th, the U.S. Senate approved the House continuing resolution (CR) to fund the government through the end of FY 2025. Shutdown averted!

This CR keeps many allocations level to FY 2024. It reduces non-defense discretionary spending by about $13B and increases defense funding by about $6B.

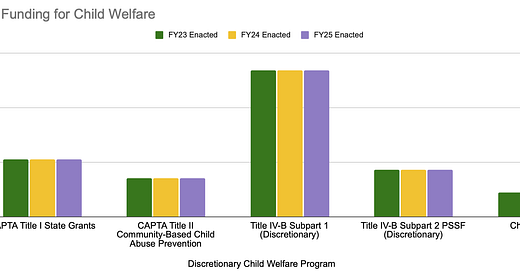

Federal child welfare funding is mostly mandatory. The primary programs that rely on discretionary funds from appropriations are level funded under this CR:

A CR comes with elements that impact oversight and implementation of funding:

Flexibility. An administration has more leeway to reprogram funds to other purposes under a CR. This one has very broad categories to allow that.

Uncertainty. It’s harder to start new projects, execute contracts, or hire with short-term funding. Many programs take a cautious approach during a CR.

Lock-In. Multiple years of CRs means policies persist, with no Congressional investments or demand for new directions.

Inflation. Level funding erodes. Discretionary Title IV-B Subpart 1 would now need $293M just to have the same purchasing power it did in FY23 with $269M.

When we adjust the topline funding for inflation compared to FY23, we can see how this plays out across the discretionary programs.

But this is Child Welfare Wonk. We don’t just have toplines for you; we analyzed all 72 ACF earmarks that the CR ended to give you the deep details you need.

Updated Analysis on ACF Earmark Cuts

Much of the real-term (AKA not inflation-adjusted) discretionary spending cuts in the CR come from reducing Congressionally Directed Spending (AKA earmarks).

ACF had 72 FY24 earmarks totaling ~$40M. The CR continues 0 of them. Building on last week’s analysis, I dug deeper to show you some more perspective.

First up, you can see here all states losing at least $1M in ACF earmarks.

And for further insight, here are the top service categories losing out on those funds:

A parting thought; most of the child abuse earmarks are prevention, analogous to CAPTA Title II (CBCAP). A notable flag: these forgone funds equal ~6% of CBCAP.

ACF 86ing TANF Pilots

On March 10, ACF announced that it is cancelling five states’ TANF Work and Family Well-Being pilots, a bipartisan policy from the Fiscal Responsibility Act (P.L. 118-5).

No, this was not a fleet of doomed ex-fighter jet aces à la Ted Striker1, but a program from a bipartisan law meant to see how to make TANF work better at…work.

Remind Me about TANF and Work: Our overview of TANF noted that it primarily goes to things other than “basic assistance” (AKA economic supports):

TANF and Work Participation One of many reasons for that is the wonkery known as the TANF Work Participation Rate;2 a data benchmark for TANF’s work requirements.

Dating to TANF’s origin, the underlying bipartisan policy is focused on ensuring economic assistance promotes economic mobility and connection to the labor market.

Much like the Gang Starr classic3, the basic theory is “I put in work, and watch my status escalate!”. But the implementation reality is more complicated.

TANF sets two benchmarks states must meet for demonstrating work participation, or lose TANF funds: 50 percent for all families, and 90 percent for two-parent families.

A workaround (to work) is that states can get lower benchmarks by lowering caseloads; another way to maintain funding is to just serve fewer families.

This reporting requirement also measures more process than outcomes. All of which is why Congress began an experiment with new approaches last year.

TANF Pilots: The 2023 bipartisan bill to raise the debt limit, the Fiscal Responsibility Act (P.L. 118-5) created a pilot testing TANF’s promotion of work.

TANF pilots test comprehensive strategies for promoting labor market engagement, measuring economic and wellbeing outcomes instead of participation rates.

Last July, then Acting Assistant Secretary Jeff Hill sent a letter inviting applications, which led to five states receiving approval in December to start pilots:

Why ACF is Cancelling the Pilots: The announcement of the cancellation of the five pilots does not directly question the merits of their projects.

It argues that the Biden Administration should not have selected states after losing the election, and should have handed the decision to the Trump Administration.

What Happens Next: ACF will not hold the pilot states to their workforce participation rate benchmarks this year. But they otherwise cannot proceed.

ACF anticipates re-doing the application process, and says it will focus on pilots promoting work and reducing dependency. Stay tuned…

Oversight Alert: ACF Reviewing All Programs for Immigration Compliance

On March 10, ACF Acting Assistant Secretary Andrew Gradison sent a letter to state, tribal, territorial, and local government leaders about a pending ACF program review.

What’s Happening: ACF will be reviewing spending in an array of federal child welfare programs to ensure they align with Administration policy and existing law.

Recent Trump 2.0 Policy: President Donald Trump’s February 19 Executive Order “Ending Taxpayer Subsidization of Open Borders” directs all federal agencies to:

“Prevent taxpayer resources from acting as a magnet and fueling illegal immigration to the United States”; and

““[E]nsure, to the maximum extent permitted by law, that no taxpayer-funded benefits go to unqualified aliens”.

To advance this policy, the EO requires each agency to:

Identify all federally funded programs that “permit illegal aliens to obtain any cash or non-cash public benefit” and act to address them;

Ensure federal funds do not subsidize or promote illegal immigration or support “sanctuary” policies protecting against deportation; and

Enhance eligibility verification systems to prevent such impermissible payments.

ACF Statutory Focus: The EO cites the ACF-administered Personal Responsibility and Work Opportunity Reconciliation Act of 19964 (P.L. 104-193) as its core example.

PRWORA has always expressly barred anyone unlawfully present in the U.S. from participating in an array of child welfare and related programs, including:

Temporary Assistance for Needy Families (TANF);

Title IV-E; and

Social Services Block Grant (SSBG).

What ACF Will Review: In announcing this review, ACF stated that while the law has always barred such payments, “the promise of that law has been eroded”.

The letter notes that recipients receive substantial ACF funding for relevant programs, and that as it reviews programs for compliance the agency will focus on:

Improving eligibility verification;

Deterring fraud; and, as applicable,

Revoking grants.

Future ACF announcements will detail what this expanded oversight will look like and what states will need to show to demonstrate compliance.

To Watch: The recent bipartisan Title IV-B reauthorization (P.L. 118-258) includes a requirement that ACF reduce IV-B administrative burden at least 15 percent, by:

Analyzing hours spent on paperwork requirements;

Revising data collection and streamlining reporting; and

Seeking input from jurisdictions to harmonize reporting with similar programs.

While IV-B is different, many of its requirements intertwine with these same programs.

We anticipate Congress will monitor how the administration expands immigration enforcement in this way while simultaneously reducing administrative burden.

CWW Analysis: Funding Uncertainty

Assessing State Vulnerability to Federal Funding Fluctuations

This week’s ACF program oversight announcements are happening in a broader moment of federal fiscal policy uncertainty, including budget reconciliation

Taken together, 2025 brings a nonzero chance of significant changes to and reductions in funding for key programs including:

Title IV-E of the Social Security Act (57% of federal child welfare funds)

TANF (19% of federal child welfare funds)

Social Services Block Grant (SSBG) (10% of federal child welfare funds)

Medicaid (7% of federal child welfare funds, not including its coverage)

Over half of child welfare funding comes from state and local sources, but that’s a national level average that masks significant variability.

The key to understanding states’ relative risk from federal funding uncertainty requires understanding both what they receive and what they invest.

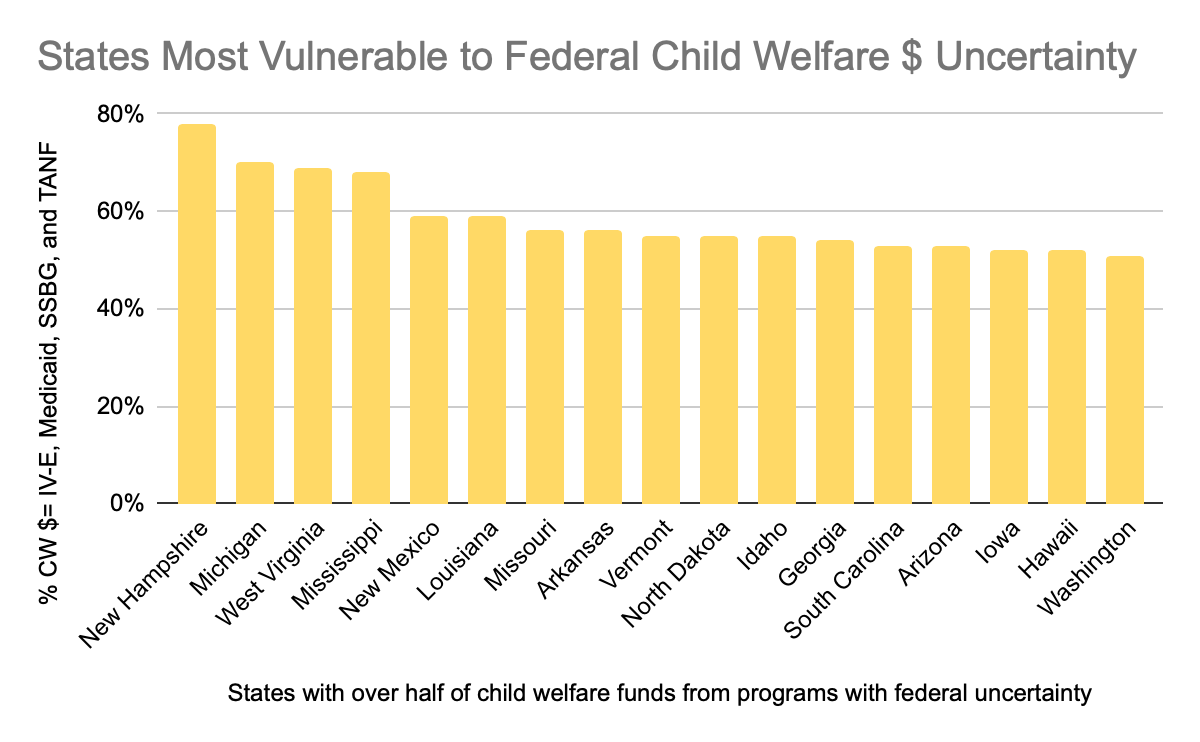

Introducing the Child Welfare Wonk Federal Uncertainty Vulnerability Index

Nothing cuts through the fog of confusion and overwhelming data like a good chart. So Child Welfare Wonk is here to offer you the Federal Uncertainty Vulnerability Index.

To assess which states face the greatest risks to their total child welfare funding, this analysis looks at the most recent ChildTrends Child Welfare Financing Survey.

This data set is unique in offering us details on child welfare agencies’ total spending, broken out by state/local and federal funding.

By crunching the available data,5 we can see which states report disproportionately relying upon these federal programs for their child welfare funding.

This inaugural Federal Uncertainty Vulnerability Index finds 17 states that report over half of their total child welfare spending from IV-E, Medicaid, SSBG, and TANF.6

Below we dig in even more on the financing survey. Whenever a new edition comes out, we will run this analysis again to keep you apprised on the latest.

Show Me the Money: Financing Survey

Those of you who take the time to rummage through Child Welfare Wonk’s footnotes have likely surmised that I am a ChildTrends enthusiast.

Their biennial Child Welfare Financing Survey is the Jerry Maguire of child welfare policy, offering a “show me the money!” breakdown of child welfare financing policy.

What it Does: Every two years, ChildTrends releases a survey of all state child welfare agencies about their spending. It breaks this down by local, state, and federal sources.

Why it Matters: Federal spending data are comprehensive and important, but give us only part of the picture. Understanding what states say they spend gives context.

What Kind of Stuff it Tells Us (In Charts):

We begin with insight into which states had the largest increases and decreases in agency spending, the kind of thing that prompts good federal policy questions.

The longevity of the survey also lets us see things like this; ten years of total agency expenditures. So we can see that it is steadily increasing, but so what?

Here’s where it gets interesting. Total spending keeps rising slightly, but now we also see that at the same time, the state/local share is slowly increasing, to almost 60%.

That tells us that pressure on state child welfare agency budgets must generally be rising, especially for our 17 states disproportionally reliant on key federal funds.

And finally, this one shows us the top federal sources.

Check Out the Most Recent Version: Child Welfare Financing Survey (SFY 2020)

Download the Data: SFY Survey Data Tables7

That’s it for this Monday. Have a good week, Wonks!

Sorry not sorry if you now have quotes from the 1980 Leslie Nielsen classic stuck in your head. A personal favorite- the “…and that’s when my drinking problem began…” gag…

Aptly enough titled “Work”, and in this wonk’s opinion a much more engaging way to put the message out there than the Riverside County commissioned Work Makes the Difference album….

If you really want to wonk out, this version includes the law, prior drafts, and the Congressional record from its development and deliberation.

Standard caveats apply; every data set has strengths, weaknesses, and limitations. This one has to exclude CA and WY since they did not report state/local spending. And some states did not report for all analyzed federal programs, and so may have greater federal uncertainty vulnerability risk than we can see.

Analysis excludes CA and WY, which did not report state/local spending data.

Go deeper on your state, or really wonk out and do your own analyses!

I've been writing about child welfare failures in WA. I think you and your readers would like the series of 3 I've put up. https://bobcoleman.substack.com/

Very impressed you worked in a Gang Starr reference Zach! Putting aside the coolness of the FUVI, I'm curious about your suggestion of a nonzero chance of reductions in federal financing and your thinking there. Is that based on overall sources, or would you ascribe that to particular sources - like the non IVE federal funds given the threats to Medicaid and SSBG for example. I'm personally wondering about the volatility in the economy and employment and its short and long-term impacts on child welfare.